Introduction

In 2025, finance apps use AI analytics, real-time insights, and automation to help users manage money, invest smarter, and build long-term wealth securely.

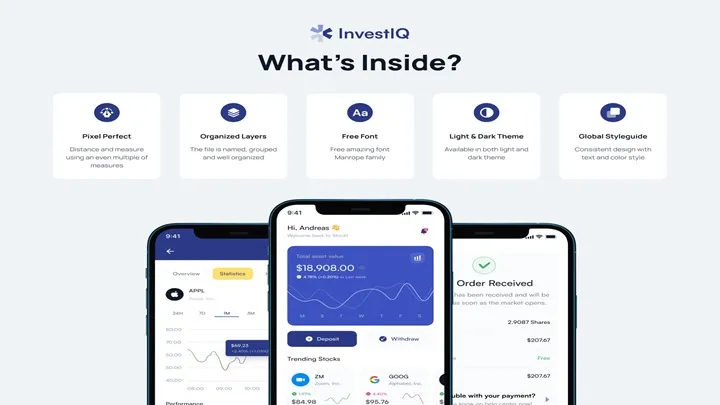

1. InvestIQ – AI Investment Advisor

Category: Investing & Trading

InvestIQ guides smarter investing:

- AI portfolio analysis

- Risk assessment tools

- Real-time market insights

- Auto rebalancing

- Personalized investment goals

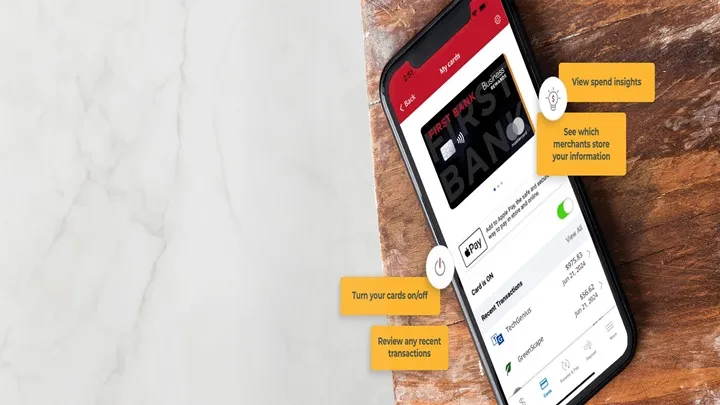

2. SpendTrack+ – Smart Expense Manager

Category: Budgeting & Expenses

SpendTrack+ controls your spending:

- Automatic expense tracking

- Spending pattern analysis

- Budget alerts

- Category breakdowns

- Financial health reports

3. CryptoGuard – Secure Crypto Manager

Category: Cryptocurrency

CryptoGuard protects digital assets:

- Secure wallet integration

- Price & volatility alerts

- Portfolio tracking

- Market trend analysis

- Multi-chain support

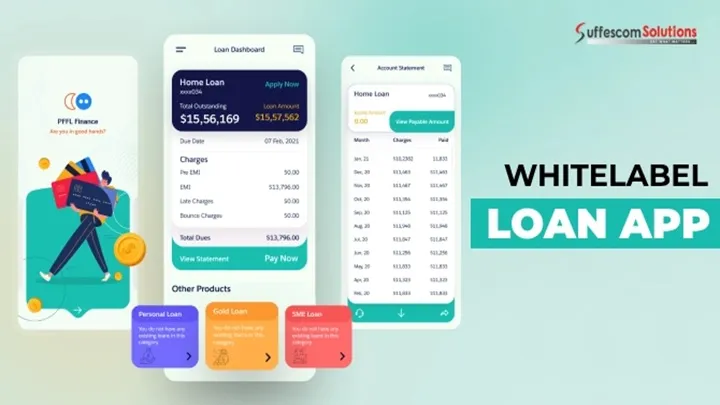

4. LoanEase – Smart Loan Planner

Category: Loans & Credit

LoanEase simplifies borrowing:

- Loan comparison tools

- EMI & interest calculators

- Payment reminders

- Credit score monitoring

- Repayment optimization

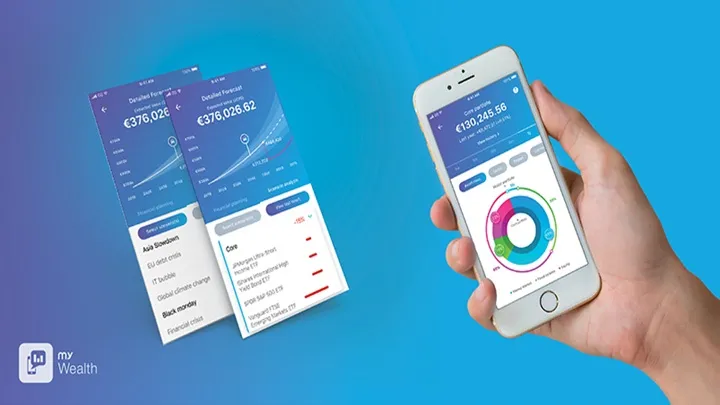

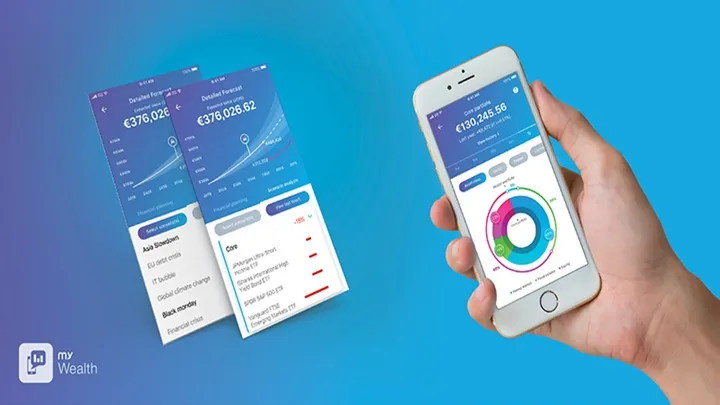

5. WealthPath – Long-Term Wealth Planner

Category: Financial Planning

WealthPath builds your future:

- AI retirement planning

- Savings goal forecasting

- Investment diversification

- Tax optimization insights

- Net worth tracking

Conclusion

The Top 5 Finance & Investment Apps of 2025 — InvestIQ, SpendTrack+, CryptoGuard, LoanEase, and WealthPath — help users gain financial clarity, confidence, and control through smart AI-powered tools.